The War for the App Store Wallet Continues

I’ve been tracking the regulatory battles surrounding the App Store for the better part of a decade now, and just when I think the dust has settled, another storm kicks up. It is late December, the holiday rush is winding down, and yet the legal teams at Cupertino and Dallas are clearly working overtime. The latest development out of India caught my eye this morning, and frankly, it feels like we are watching a rerun of the European Digital Markets Act (DMA) saga, but with higher stakes in a critical growth market.

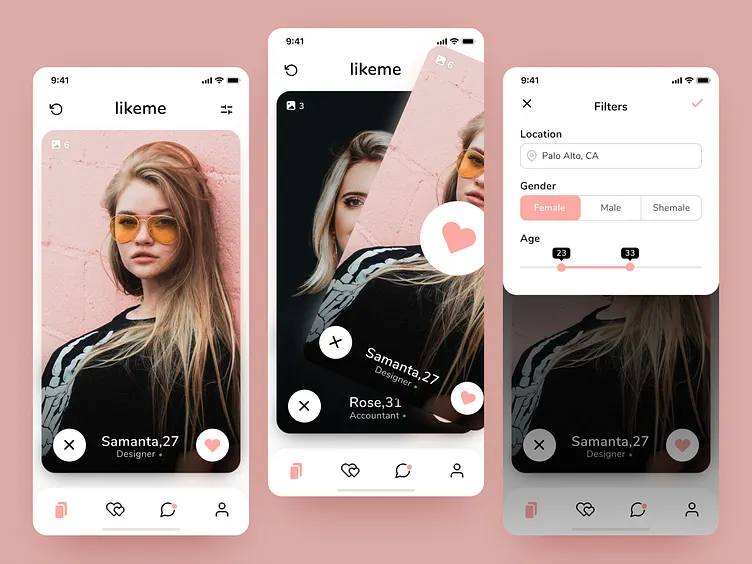

Match Group, the parent company behind Tinder and Hinge, is officially pushing the Competition Commission of India (CCI) to impose a significant penalty on Apple. The core argument isn’t new, but the aggression behind it is noteworthy. They are arguing that Apple’s conduct regarding alternative payment systems is anti-competitive.

I find this fascinating because it highlights a fundamental disconnect between how Apple views its ecosystem and how developers view their businesses. For Apple, the App Store is a curated, secure boutique. For Match, it’s a utility that charges rent.

Why India is the New Battleground

I often tell people to stop looking solely at the EU for regulatory trends. While Brussels set the tone earlier this year, New Delhi is where the volume is. The Indian market is massive, and for digital goods—like Tinder Gold subscriptions—it is a goldmine.

The specific grievance here revolves around the “Apple Tax.” Even when Apple allows alternative billing (which they have been forced to do in various regions), they often still charge a commission, usually around 27% instead of 30%. Match Group argues that this renders the alternative payment option pointless.

I have to agree with the logic here. If I’m a developer and I have to build my own payment infrastructure, handle my own customer support for refunds, and *still* pay Apple 27%, the math rarely works out. It’s actually more expensive than just using Apple’s In-App Purchase (IAP) system.

This move by Match to demand a “heavy fine” suggests they are done negotiating. They want the regulator to punish Apple into compliance, not just scold them.

The Security Shield Defense

Whenever I discuss **Apple ecosystem news**, the counter-argument from Cupertino is always consistent: security and privacy. **iOS security news** outlets frequently cite Apple’s “walled garden” approach as the primary reason why iPhones have less malware than Android devices.

I use an iPhone 16 Pro as my daily driver, and I genuinely value that security. I don’t want to worry about a rogue app stealing my banking data. However, I struggle to see how allowing Tinder to use a direct credit card processor compromises the operating system’s integrity. We aren’t talking about side-loading unverified IPAs here; we are talking about payment processing within a verified app.

Apple’s defense relies on the idea that they provide the audience, the tools, and the trust. They believe they are entitled to a cut of the commerce that happens because of their hardware.

The Hardware Lock-in Factor

This situation makes me think about how deep the ecosystem rabbit hole goes. It’s not just about the phone anymore. When I look at my desk, I see the integration that keeps me paying. I have my **AirPods Pro** for calls, my **Apple Watch** tracking my stand hours (which I am currently failing at), and my **HomePod mini** playing background lo-fi.

If the CCI forces Apple to open up payments completely, does that break the seamlessness?

For instance, if I subscribe to a service via a third-party payment flow on my iPhone, does that subscription automatically sync to the app on my **Apple TV**? Or do I have to log in again? One of the best things about **Apple TV news** lately has been the improved user switching and single sign-on features. If we fragment the payment layer, we might break that “it just works” magic.

I recently bought a **Vision Pro**, and the friction there is already high enough. I don’t want to be typing credit card numbers into a floating window in spatial computing. I want to double-click the top button and be done.

However, convenience shouldn’t necessarily justify a monopoly on transaction fees. That is the line the CCI has to draw.

Nostalgia for Simpler Times

Sometimes, writing about these billion-dollar corporate squabbles makes me miss the old days. I was browsing a forum recently dedicated to **iPod revival news**, where modders are putting 1TB SD cards into old 5th Gen iPods. There is a purity to that era.

Back then, **iPod news** was about a click wheel and a headphone jack. You bought a song on iTunes for 99 cents, and you owned it. There were no recurring subscriptions, no 30% cuts on “consumable digital goods,” and no antitrust lawsuits about dating apps.

I even saw a thread about **iPod Shuffle news**, discussing how the screenless design was the ultimate “digital wellbeing” device before we knew we needed it. It’s funny how **iPod Nano news** and **iPod Mini news** generate more warm fuzzy feelings in 2025 than the latest iPhone release.

Even the **iPod Touch news** cycles were simpler—it was just an iPhone without the phone. Now, the device is the storefront, the bank, and the regulator all in one. The complexity of the modern **Apple ecosystem news** cycle is a direct result of the iPhone becoming the most valuable real estate in the world.

The Ripple Effect on Other Services

If the CCI cracks down on Apple, it won’t just affect Tinder. It impacts everyone. I’m thinking about how this changes the landscape for **Apple health news**. Health apps often have premium tiers. If they can bypass Apple’s cut, maybe subscriptions become cheaper? Or, more likely, developers keep the price the same and pocket the difference.

Consider **AirTag news** and the “Find My” network. Apple opened that up to third parties under pressure. Now we have Chipolo and Pebblebee. It didn’t kill the AirTag; it just made the ecosystem richer.

I suspect the same would happen with payments. If Spotify or Netflix could bill me directly in the app without friction, I’d probably still use Apple Pay for the convenience, but the *option* forces Apple to compete on service quality, not just gatekeeping.

The Vision Pro Dimension

We have to talk about the spatial elephant in the room. **Apple Vision Pro news** has been dominating the tech cycle throughout 2025. As the headset slowly moves from a developer toy to a consumer product (hopefully with a cheaper “Air” model by 2026), the App Store rules matter even more.

Developers are already hesitant to build for visionOS because the user base is small. If Apple takes 30% of their revenue on top of the high development costs, many just won’t bother. We’ve seen this with the lack of native apps from major players.

There was a rumor recently—let’s call it **Vision Pro accessories news**—about specialized controllers. Some **Vision Pro wand news** leaks suggested Apple might release haptic controllers for gaming. If they do, they need a robust game library. And game developers are the most vocal critics of the App Store tax.

If the CCI ruling in India forces a change, it could lower the barrier for entry for developers globally, assuming Apple applies the changes worldwide to avoid a patchwork of regulations.

Privacy vs. Profit

I want to touch on **Apple privacy news** again because it is the ultimate trump card. Match Group says Apple uses privacy as a shield for profit. I think there is truth to that, but I also think Match Group doesn’t care about my privacy at all. They just want their margins back.

It is a battle between two greedy entities. One controls the platform; the other controls the service.

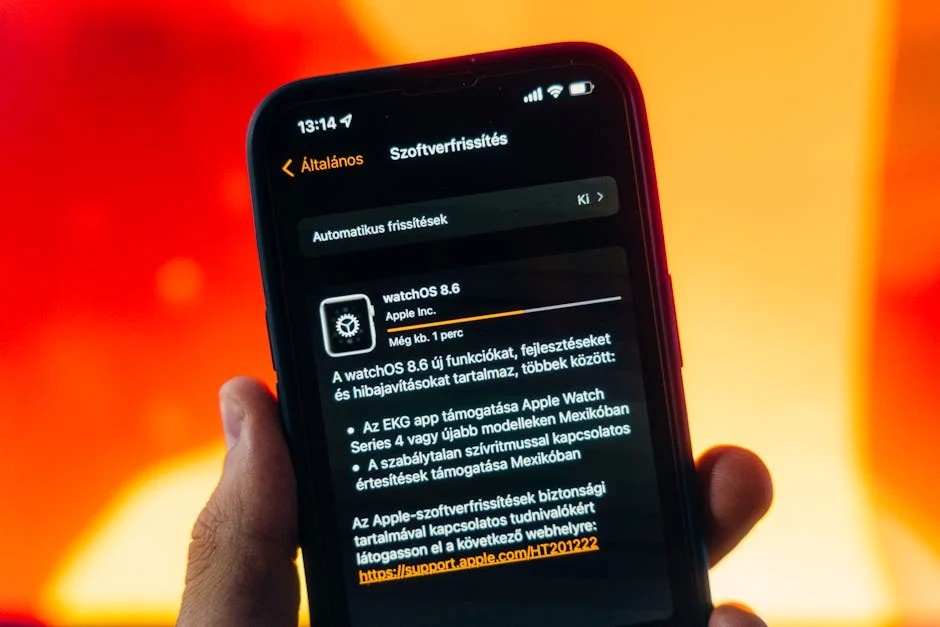

I remember when **iOS updates news** used to be about cool new features like widgets or Control Center. Now, every update seems to include “compliance frameworks” for the EU, Japan, or South Korea. It feels like the lawyers are designing the OS as much as the engineers are.

The Accessories Market

While the software battle rages, the hardware train keeps rolling. **Apple accessories news** has been interesting lately. The shift to USB-C is fully complete, and we are seeing some wild integrations.

I recently tested a new stylus that isn’t an Apple Pencil but works via the new protocols—some fascinating **Apple Pencil news** there. But even hardware is tied to software. The pairing process, the firmware updates—it all goes through the App Store or iOS system services.

If antitrust regulators decide that Apple’s control over the “ecosystem” is too tight, could they eventually force Apple to open up the H1/H2 chip protocols? Could we see **AirPods Max news** where a third-party headphone connects just as magically as Apple’s own?

That sounds great for consumer choice, but terrible for user experience. The reason I buy **AirPods** is that I don’t have to fiddle with Bluetooth settings. If regulation breaks that integration in the name of “fairness,” I think the consumer actually loses.

Looking Ahead: 2026 and Beyond

So, where does this leave us as we head into the new year?

I suspect the CCI will take its time, but the pressure is mounting. India wants to be a tech superpower, and enforcing fair competition is part of that maturity.

If Apple is fined heavily, they will likely appeal. This will drag on. But the writing is on the wall. The era of the undisputed 30% cut is ending. We saw it crack in the EU, and now the cracks are spreading to Asia.

By mid-2026, I expect we will see a new business model from Apple. Perhaps a lower base fee with add-ons for specific services (hosting, payment processing, discovery).

For now, I’m keeping my eye on **Siri news**. With the AI overhauls we saw this year, Siri is becoming the ultimate interface. If Siri begins suggesting subscriptions or handling transactions autonomously, the “who owns the customer” battle will get even bloodier.

Also, keep an eye on **iPad vision board news**—a weird niche, I know, but the way iPadOS is morphing to resemble a “lite” visionOS suggests a convergence that will unify the storefronts even further.

My Takeaway

I don’t have a horse in this race. I pay my Apple One subscription because I’m lazy and I like the music and TV shows. But as a technical observer, I see Match Group’s move as a necessary stress test for the system.

Monopolies get lazy. They stop innovating on the business side because they don’t have to. If the CCI puts a fire under Apple, we might actually get a better App Store out of it—one that competes for developers’ loyalty rather than demanding it.

The **Apple AR news** pipeline suggests the future is spatial and digital. If that future is going to be vibrant, the economy powering it needs to be fair. Right now, in India, Match Group is betting big that it isn’t.

And frankly, watching **iPod Classic news** videos on YouTube is a nice reminder that tech empires rise and fall based on how they treat their users. Apple won the music war by being better than piracy. They need to win the app war by being better than the open web, not by locking the doors.

I’ll be watching the filings in India closely over the next few weeks. It’s going to be a bumpy ride into 2026.

A Note on Legacy Hardware

Before I wrap up, I have to mention a strange trend I’ve noticed. Amidst all this high-stakes legal drama, the second-hand market for **iPod Nano news** and devices is spiking. I think people are tired of subscriptions.

There is a tangible fatigue with the “everything is a service” model. The Match vs. Apple fight is essentially a fight over who gets to charge you rent for your digital life.

Maybe that’s why I dusted off my old click-wheel device last night. No EULA, no payment processing fees, just music. It was refreshing. But then I put my **AirPods Pro** back in, tapped my **Apple Watch**, and checked my notifications.

The ecosystem has me. The question is, how much will Apple be allowed to charge to keep me there? That is what the CCI has to decide.